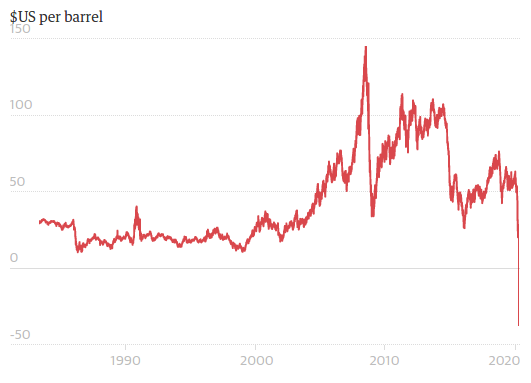

The world is facing the greatest economic depression since the 1930s. In one chilling omen, the US oil price plunged below zero for the first time in history.

The oil industry pumps out 100 million barrels of oil per day, at the start of this year it was selling for $60 per barrel. But on April 20th 2020, it fell below zero as there was so much unwanted oil, owners paid people to take it off their hands.

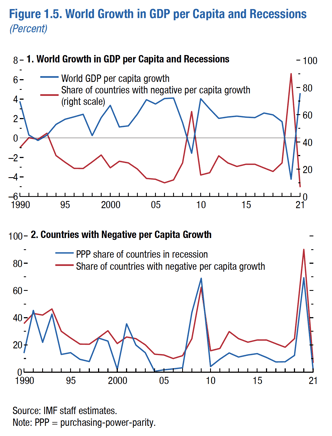

Sharing data is also critically important for businesses facing the economic catastrophe of the government lockdowns. In its World Economic Outlook, the I.M.F. projected that the global economy would contract by 3 percent in 2020, an extraordinary reversal from early this year, when the fund forecast that the world economy would outpace 2019 and grow by 3.3 percent. This year’s fall in output would be far more severe than the global financial crisis, when the world economy contracted by less than 1 percent between 2008 and 2009.

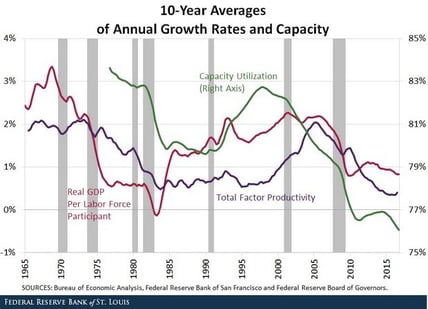

To be honest, something needed to change even before COVID-19 reared its ugly head. In my book, The AI Age, I discuss how the world needed a massive productivity boost. Across the globe, rates of gross domestic product (GDP) growth have been shrinking. Moreover, this has been true for three decades. The impact of great inventions, such as the steamship and telegraph, had not been repeated.

And this deficit of innovation, combined with unfavorable demographic trends, flagging educational attainment and rising wealth inequality, slowed economic progress for the foreseeable future. Unless we found a way to improve productivity.

Over the past fifty years, of the 3.5 percent average GDP growth over that period, 1.7 percent has come from expansion in the labor supply and 1.8 percent from productivity growth. In the next fifty years, aging populations and other demographic effects will result in the labor supply expanding by a dismal 0.3 percent. Productivity is the crucial lever to pull, and was already in need of a yank, before the global COVID-19 crisis. So what can we do to increase productivity rapidly?

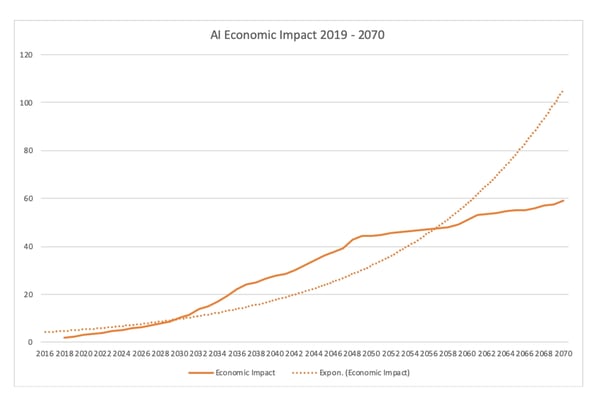

The answer lies in technology, such as Artificial Intelligence which can significantly improve productivity. At Critical Future, we’ve developed a robust econometrics model to assess the impact of the AI market over the coming years. We found that AI will unlock US $19 trillion in market value by 2035. That is about the size of the entire US economy which will be distributed to those who effectively deploy AI.

AI relies on data. Relevant and specific data. The sort of data which currently lies unused and dormant in the virtual volts of the world's leading companies. Shoshana Zuboff, a professor at Harvard Business School, describes this in her 2019 book, The Age of Surveillance Capitalism, as a fundamental shift in how wealth is created. Rather than extracting “labor surplus” from workers, today’s tech giants extract a “behavioral surplus” from their customers. This is "behavioral data we give to tech companies over and above that which they need to make their services work better for us,” Zuboff says.

Google pioneered this model and showed just how much hidden value there is in data. All data. The irony of Google’s success is that it was built on what was previously considered waste data or 'data exhaust'. Author Kenneth Cukier explains in his book Big Data: A Revolution That Will Transform How We Live, Work, and Think that Google capitalized on waste data to build one of the most successful companies of our times, showing just valuable it is for companies to collect and utilize all the data possible:

Other search engines in the 1990s had the chance to do the same but did not pursue it. Around 2000, Yahoo! saw the potential, but nothing came of the idea. It was Google that recognized the gold dust in the detritus of its interactions with its users and took the trouble to collect it up. . . . Google exploits information that is a by-product of user interactions, or data exhaust, which is automatically recycled to improve the service or create an entirely new product.

This is what every industry needs to do to a greater or lesser extent. Extract value from their data. Just as google turned "data exhaust" into one of the most valuable companies in the world market cap over $850 billion, other industries use their data to fuel growth.

Tech giants do not own all the specific industry and business data. For example, they do not have data on banking transactions or medical operations or manufacturing outputs, or shipping vessels routes. There is a universe of untapped data out there waiting for bright sparks to extract it. Because data is verticalized, it is possible for industry leaders and key players to build defensible business models in specific sectors.

But no one industry leader has oversight of the total market. Sharing data enables key players within an industry to build a larger economic model.

Take shipping for example. If the oil majors and the leading shipping companies come together to share data on vessel routes, AI can then be applied in the form of machine learning and maritime analytics to optimize vessel journeys. This will mean higher net revenue for shipping companies, lower costs for energy companies in transportation and a big boom for sustainability. Increased efficiencies and less carbon emission. It is an obvious win-win. Add to the mix the myriad data that vessels themselves generate (e.g. position, bunker ROB, port calls) every day and you have a lot of "exhaust" for maritime data analytics.

OrbitMI and Critical Future partnered to quantify how much economic value can be unlocked by sharing in shipping. We turned our mathematical economists to quantify the unrealized economic value. The results showed a staggering $237 billion can be generated by sharing in maritime.

Just as Google turned its "data exhaust" into gold, sharing in shipping is also relatively low-cost. It doesn't require large capital expenditure, investments or restructuring programs. It does require a big leap in thinking. Industry leaders are trained to be secretive and guarded about their data. But these mental models need to be unlearnt to digitally transform.

Do industry leaders need to succeed in digitizing? Yes. If industry leaders don't digitize, they may find their market shares evaporate. The threat of digital disruption is real. Examples of tech firms taking advantage of new technology opportunities to throw industries into disarray abound.

Other industries will also be reshaped by digitization and the key players now will see their market share vanish. For example, as shipping moves towards autonomous ships in the coming decades, it could be reshaped by tech firms with stronger digital competencies. Amazon signaled its intent to enter the shipping freight market when it gained approval from the Federal Maritime Commission in the US to act as an Ocean Transportation Intermediary. As the CEO of Maersk explains:

Amazon is a threat if we don’t do a good job for them… If we don’t do our job well, then there’s no doubt that big, strong companies like Amazon will look into whether they can do better themselves.

Soren Skou, CEO, A.P. Moller Maersk A/S2

This push toward digital transformation push has only intensified by COVID-19. Network operators have confirmed the digital surge. As of last week, AT&T reported, "Wireless voice minutes of use was up 39% compared to an average Monday. Wi-Fi Calling minutes of use was 78% higher than an average Monday. Consumer home voice calling minutes of use were up 45% from an average Monday." The company said its core network traffic, including "business, home broadband and wireless usage," was up 27% on Monday compared with the same day last month. We have become more reliant on digital technology from socialising, to learning and working.

A Harvard Business Review states in "Coronavirus Is Widening the Corporate Digital Divide"

Nothing quite compares to the physical-digital divide COVID-19 is revealing and how it affects the nature of work...The stakes for digital transformation have increased dramatically. Now, digitizing the operating architecture of the firm is not simply a recipe for higher performance, but much more fundamental for worker employment and public health. This is creating a new digital divide that will deepen fractures in our society. The firms that cannot change overnight will be left way behind, exposing their employees to increasing risk of financial and physical distress.

So what do established industry players need to successfully digitize to maintain their market shares? The first key activity is building ecosystems. This is something big tech excel at, as Satya Nadella CEO of Microsoft explains is his book Hit Refresh: The Quest to Rediscover Microsoft's Soul and Imagine a Better Future for Everyone:

Our original business model was built on an ecosystem of partners—When I became CEO, I sensed we had forgotten how our talent for partnerships was a key to what made us great. It’s the kind of thing that can happen to any great company. Success can cause people to unlearn the habits that made them successful in the first place. We knew we needed to retrain our partnership muscles.

Nadella set out to build a partnerships and ecosystems in which data is shared in order to maximize the effectiveness of Microsoft in delivering for clients. The results have been impressive as Microsoft’s revenue grew 30% over 2017-19 to $126 billion and is expected to increase 11% to nearly $139 billion by 2021.

But to build such ecosystems, many traditional industries need to "think differently". Unlearn the traditional mindsets which operate on a "zero sum game basis". Learn to work with other companies in an ecosystem. Open up to new ways of doing things. This thinking differently process we aim to support with the report "The Impact of Sharing in Shipping" of OrbitMI. This is "disruptive content" aimed at challenging established views. We look forward to having this discussion with the shipping industry and wider business community on sharing.

Changes bring challenges but also opportunities. The COVID-19 crisis forces all of us to find ways to optimize productivity. The time for coming together to jointly solve industry challenges and increase efficiencies is now. The time for sharing in industries like shipping and many others is now. Let's come together and share to build a better world.

These Stories on Data Sharing